The Basic Principles Of Paul B Insurance

Wiki Article

What Does Paul B Insurance Do?

Table of ContentsThe Main Principles Of Paul B Insurance The Greatest Guide To Paul B InsuranceThe smart Trick of Paul B Insurance That Nobody is DiscussingThe smart Trick of Paul B Insurance That Nobody is Talking AboutUnknown Facts About Paul B InsuranceNot known Facts About Paul B Insurance

Coinsurance: This is the percent (such as 20%) of a medical cost that you pay; the rest is covered by your medical insurance plan. Deductible: This is the quantity you spend for protected treatment before your insurance starts paying. Out-of-pocket maximum: This is the most you'll pay in one year, out of your very own pocket, for protected healthcare.

Out-of-pocket prices: These are all expenses over a plan's premium that you must pay, consisting of copays, coinsurance and deductibles. Premium: This is the monthly quantity you pay for your medical insurance strategy. As a whole, the greater your costs, the reduced your out-of-pocket costs such as copays and coinsurance (as well as the other way around).

By this step, you'll likely have your choices limited to just a couple of plans. Right here are some things to consider following: Examine the scope of services, Return to that summary of benefits to see if any of the strategies cover a broader range of solutions. Some might have better insurance coverage for things like physical therapy, fertility therapies or mental healthcare, while others may have much better emergency protection.

How Paul B Insurance can Save You Time, Stress, and Money.

In some instances, calling the plans' customer solution line might be the best way to obtain your inquiries responded to. Create your questions down in advance, as well as have a pen or digital gadget handy to tape the responses. Below are some instances of what you could ask: I take a specific drug.Make sure any kind of strategy you select will certainly pay for your normal as well as necessary treatment, like prescriptions and experts.

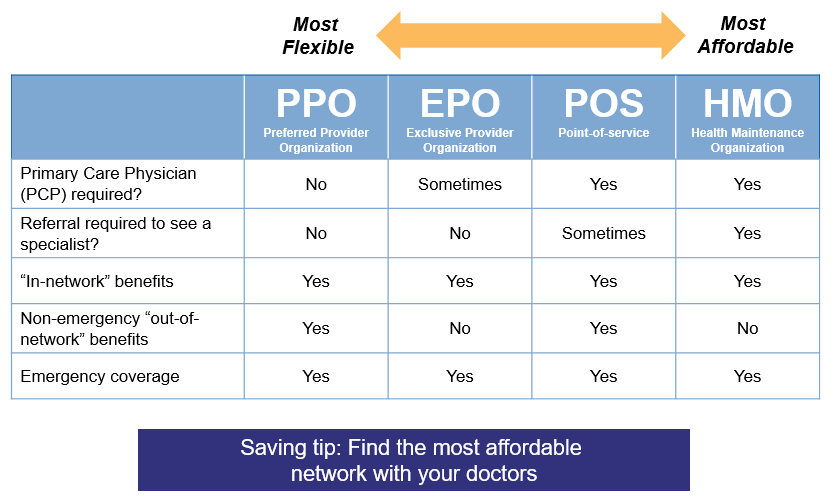

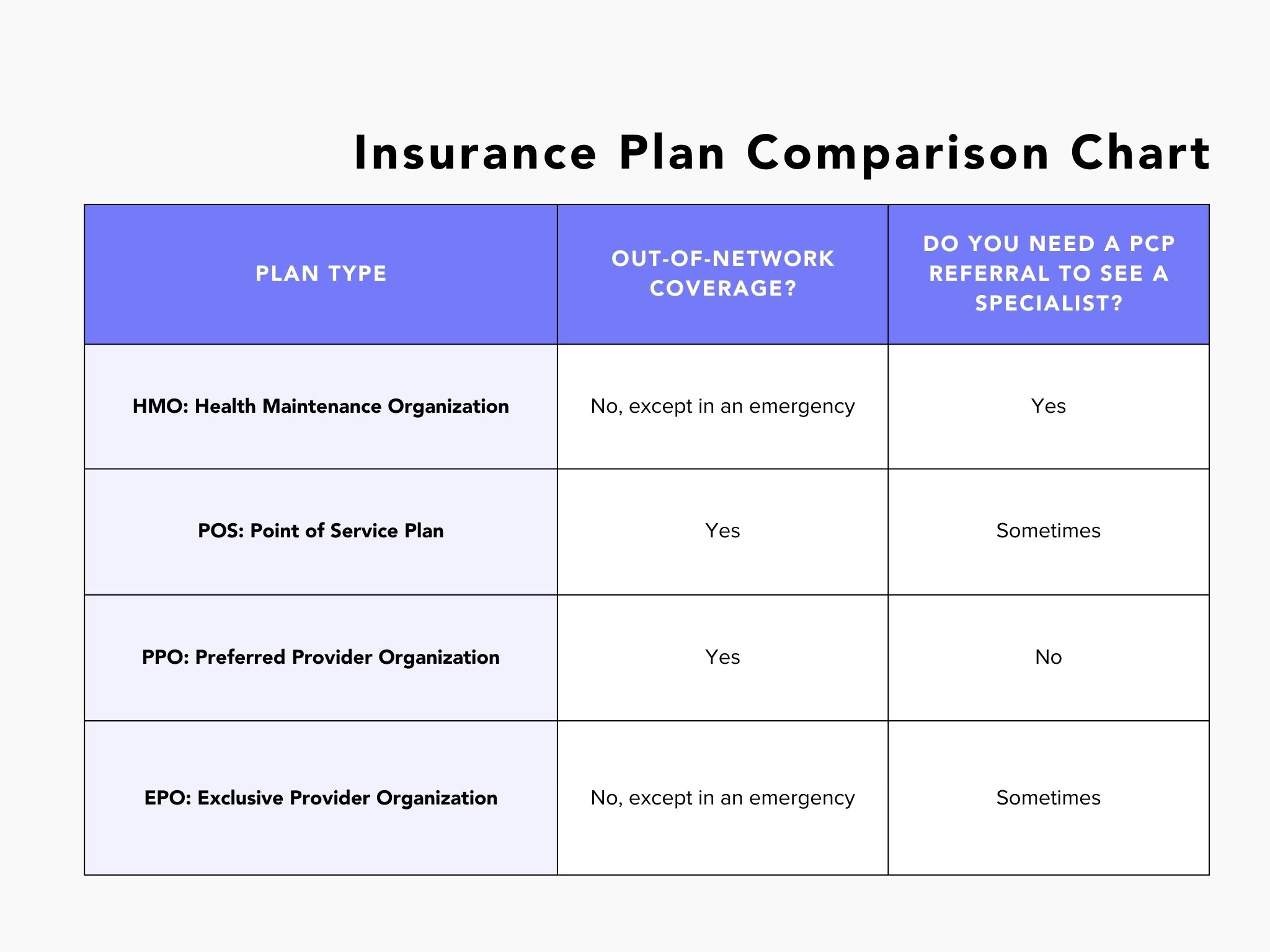

As you're trying to find the best health insurance policy, an excellent action is to figure out which intend kind you need. Each strategy kind equilibriums your expenses and also dangers in a different way. Think of your health care use and also budget plan to find the one that fits.

Medical insurance (likewise called health insurance coverage or a health and wellness plan) aids you pay for healthcare. All medical insurance plans are different. Each strategy sets you back a different amount of cash and covers different services for you as well as participants of your household. When choosing your insurance plan, spend some time to think regarding your family's medical requirements for the next year.

Excitement About Paul B Insurance

You can find plan summaries and also get information about health strategies for you and also your children in your state's Health Insurance Industry. Each plan in the Marketplace has a recap that includes what's covered for you and your family members.When comparing wellness insurance policy plans, take a look at these expenses to assist you decide if the plan is appropriate for you: This is the quantity of money you pay each month for insurance policy. This is the quantity of money you need to invest before the strategy starts paying for your health care.

This is the amount of money you pay for each health care service, like a browse through to a wellness care service provider. This is the highest quantity of cash you would have to pay each year for health treatment services.

Right here's what to search for in a wellness plan when you're considering companies: These suppliers have an agreement (contract) with a wellness plan to supply clinical services view publisher site to you at a discount. In many cases, going to a recommended company is the least expensive means to obtain health and wellness treatment.

The Of Paul B Insurance

This implies a health insurance plan has different expenses for different service providers. You might have to pay more to see some suppliers Get More Info than others. If you or a member of the family currently has a healthcare provider and you want to keep seeing them, you can learn which plans include that carrier.

When contrasting health and wellness insurance policy strategies, understanding the differences in between medical insurance kinds can aid you pick a strategy that's best for you. Wellness insurance policy is not one-size-fits-all, and also the variety of options shows that. There are a number of kinds of medical insurance prepares to pick from, as well as each has associated prices and also constraints on providers and check outs.

To get ahead of the game, check your present health care plan to review your protection and also understand your strategy. As well as, examine out for more specific medical care strategy information.

Getting My Paul B Insurance To Work

If it's an indemnity strategy, what kind? With several strategy names so obscure, exactly how can we figure out their kind?

A plan that gets with clinical service providers, such as health centers and also doctors, to create a network. Clients pay much less if they make use of suppliers that belong to the network, or they can make use of service providers outside the network for a higher expense. A strategy making up groups of hospitals as well as doctors that agreement to give comprehensive clinical services.

Such strategies normally have varying protection levels, based upon where solution occurs. As an example, the plan pays more for solution executed by a restricted set of internet providers, much less for services in a wide network of providers, as well as even less for solutions outside the network. A strategy that provides pre-paid thorough treatment.

More About Paul B Insurance

In Display 2, side-by-side contrasts of the six types of medical care strategies show the differences identified by responses to the 4 questions regarding the strategies' features. As an example, point-of-service is the only plan type that has greater than two levels of advantages, and fee-for-service is the only type that does not use a network.The NCS has not included plan types to represent these yet has identified them right into existing plan types. As before, the strategy name alone may not determine an unique and constant set of features. NCS does tabulate details on a few of these one-of-a-kind plan attributes, however. In 2013, 30 percent of medical plan individuals in exclusive industry were in plans with high deductibles, and of those employees, 42 percent had accessibility to a health savings account.

Report this wiki page